Synthetic life and Decentralized Finance (DeFi) are two groundbreaking fields poised to redefine industries, economies, and even how we perceive life itself. While Artificial Life involves creating living organisms or their digital equivalents, DeFi decentralizes the management of finances, enabling borderless and trustless transactions. When combined, these technologies offer the potential for entirely new ecosystems: a world where digital organisms can be funded, traded, or even leased.

Let’s explore this futuristic convergence, delving into its applications, potential, challenges, and why it matters to everyone—from curious kids to seasoned researchers.

What Is Synthetic Life?

Artificial Life refers to organisms or entities designed, engineered, or created through advanced technology rather than natural processes. It can be broadly categorized into two primary types:

Biological Synthetic Life

This involves the creation or modification of living organisms in laboratories. Examples include bacteria engineered to produce biofuels, lab-grown meat for sustainable food production, or yeast engineered to produce life-saving medicines like insulin. These organisms are often tailored to solve specific challenges, such as addressing climate change, improving healthcare, or enhancing food security.

Digital Synthetic Life

Digital synthetic life comprises virtual organisms programmed with artificial intelligence (AI) to mimic behaviors of real-life creatures. These digital entities, such as advanced virtual pets or simulated ecosystems, go beyond entertainment. They can model biological systems for research, simulate environmental changes, or perform automated tasks in digital environments.

Both biological and digital Artificial Life forms have practical applications, including aiding research, addressing environmental issues, optimizing manufacturing processes, and solving complex computational problems. As synthetic biology and AI advance, Artificial Life is expected to play a pivotal role in shaping industries and society.

A Primer on DeFi

DeFi, or Decentralized Finance, is a blockchain-based ecosystem for financial transactions. Unlike traditional banks, DeFi platforms use smart contracts to automate lending, borrowing, trading, and other financial operations.

Key DeFi benefits:

- Global accessibility: Anyone with internet access can participate.

- Transparency: Blockchain ensures every transaction is traceable.

- Cost efficiency: By removing intermediaries, DeFi reduces transaction fees.

When Artificial Life meets DeFi, it creates possibilities for owning, funding, or trading life forms in both biological and digital domains.

The Intersection of Synthetic Life and DeFi

Imagine this:

- A scientist develops a digital bee that simulates pollination. Instead of seeking traditional funding, they tokenize the bee as an NFT (Non-Fungible Token) and sell fractional ownership to investors via DeFi platforms.

- A startup creates lab-grown algae capable of absorbing carbon dioxide. Through DeFi, they crowdfund production and offer returns tied to the algae’s performance in reducing CO₂.

These examples hint at how Artificial Life forms can become tradable assets in DeFi ecosystems.

Applications of DeFi in Artificial Life

1. Crowdfunding Innovations

Traditional research funding is slow and often restricted to institutions. DeFi opens up research to global contributors, allowing micro-donations from millions of investors.

Example:

Platforms like Gitcoin already fund open-source projects. A similar model could support synthetic biology research, where contributors receive tokens representing ownership or future profits.

2. Tokenizing Synthetic Assets

Just as companies tokenize real estate, Digital Bioforms can be tokenized for fractional ownership.

- Biological Assets: Lab-grown bacteria engineered for biofuel could be tokenized, with tokens representing ownership of the organism or rights to its outputs.

- Digital Assets: AI-driven virtual pets or bots could be sold or leased as NFTs.

3. Leasing Digital Organisms

Artificial Life forms with practical applications, like AI models or digital organisms simulating biological systems, could be leased via DeFi platforms. Payments can be automated using smart contracts.

4. Staking for Research Funding

Users could stake tokens to fund specific research projects. In return, they might earn a share of profits or royalties generated by the resulting Digital Bioforms.

Current Trends and Real-World Examples

Synthetic Biology Milestones

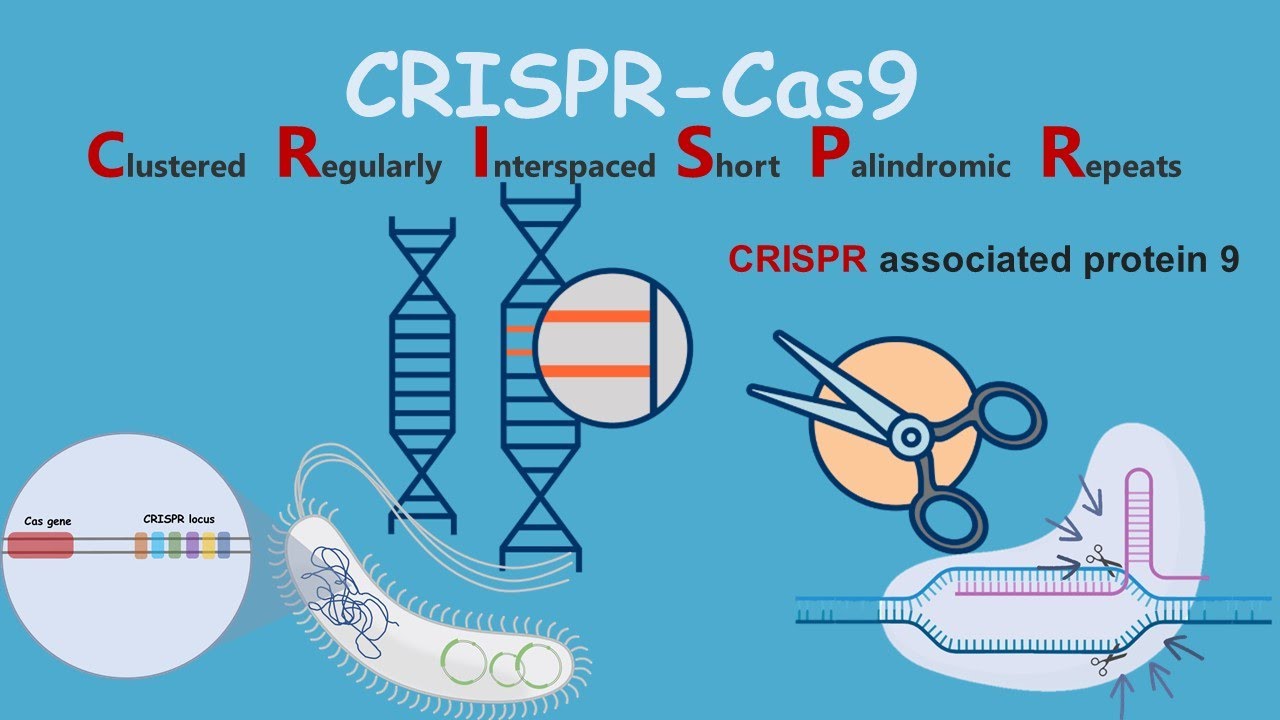

- CRISPR Technology

CRISPR has made gene editing accessible, enabling breakthroughs like curing genetic diseases and designing Digital Bioforms. - Lab-Grown Products

Companies like Upside Foods and Perfect Day are commercializing lab-grown meat and dairy, proving the viability of synthetic biology in mainstream markets. - Environmental Solutions

Synthetic microbes are being engineered to degrade plastics, clean oil spills, and absorb carbon emissions.

DeFi Milestones

DeFi has achieved significant milestones that demonstrate its potential to revolutionize industries beyond finance, including synthetic biology and digital organisms.

NFT Growth

Originally popularized as a medium for trading digital art, NFTs (Non-Fungible Tokens) have rapidly evolved to represent diverse functional assets. These include music royalties, digital identity verification, real estate ownership, and intellectual property rights. The next frontier for NFTs lies in synthetic organisms. For instance, a tokenized digital organism could encapsulate ownership, licensing rights, or usage data for cutting-edge tools in agriculture, medicine, or AI development. The utility of NFTs is growing, making them a foundational element for integrating Digital Bioforms into DeFi ecosystems.

DAO Innovation

Decentralized Autonomous Organizations (DAOs) have emerged as a powerful tool for democratizing funding. By allowing token holders to vote on project allocations, DAOs can direct capital to high-impact synthetic biology innovations. For example, a DAO dedicated to environmental research could prioritize funding for synthetic microbes that clean ocean plastics. These decentralized governance models ensure that funding decisions are community-driven, transparent, and aligned with collective goals.

Cross-Chain Platforms

Interoperable platforms like Polkadot and Cosmos are breaking barriers between blockchains, enabling seamless transactions and collaboration across ecosystems. This capability is crucial for synthetic asset trading, where assets may be tokenized on one blockchain but require integration with others for broader accessibility. Cross-chain platforms provide the infrastructure to manage and trade synthetic organisms globally, ensuring scalability and flexibility in synthetic biology marketplaces.

These milestones highlight how DeFi is becoming a key enabler for futuristic applications like synthetic life, creating avenues for growth, innovation, and inclusivity.

Case Study: Digital Bees and DeFi

Imagine a future where agriculture meets cutting-edge technology. A scientist creates BeeBot, a digital organism designed to simulate real-world pollination patterns. This virtual bee isn’t just a clever piece of programming; it’s a powerful tool for solving agricultural challenges in an increasingly digital world.

The BeeBot could:

- Be Tokenized as an NFT

By turning BeeBot into an NFT (Non-Fungible Token), ownership becomes verifiable and transferable. Each BeeBot NFT represents a unique instance of the digital organism, allowing users to trade it on blockchain-based marketplaces. Farmers, researchers, or tech enthusiasts could buy and sell BeeBots, creating a vibrant marketplace for agricultural simulation tools. - Be Leased to Agricultural Researchers

Researchers studying the effects of pollination on crop yields could lease BeeBot instead of developing costly in-house models. Through DeFi smart contracts, payments for the lease could be automated and securely transferred to the creator or current owner, ensuring a seamless transaction process. This leasing model reduces barriers to accessing advanced simulation technologies, democratizing agricultural research. - Generate Royalties for the Creator

Every time a BeeBot NFT is sold, leased, or used in a commercial application, the creator could earn royalties through smart contracts. This ensures ongoing rewards for the scientist’s innovation and incentivizes further development of such digital organisms.

Additionally, BeeBots could be upgraded with features such as regional pollination patterns or species-specific behaviors, making them more valuable. DeFi platforms not only enable transparent and automated transactions but also provide tools for fractional ownership, allowing multiple stakeholders to co-invest in BeeBot’s future evolution.

In this scenario, BeeBot is not just a research tool but a new form of financial asset, paving the way for synthetic life to thrive in the DeFi ecosystem.

Why This Matters

For Kids

Imagine owning a Pokémon-like digital pet that evolves and earns money for you. Synthetic organisms could be fun and financially rewarding.

For Investors

Synthetic life could become a new asset class, much like cryptocurrencies. Early adopters could profit from owning stakes in cutting-edge technologies.

For Researchers

DeFi democratizes funding and provides new ways to monetize intellectual property, accelerating innovation in synthetic biology.

Challenges and Ethical Considerations

While the opportunities are exciting, they come with challenges:

Ethics

- Should synthetic organisms be treated as living beings or products?

- What happens if a synthetic life form, biological or digital, causes harm?

Regulation

Governments have yet to establish clear rules for synthetic biology and DeFi, leading to potential risks for investors and creators.

Fraud and Security

DeFi platforms are not immune to hacks and scams. Robust security measures and audits are crucial.

The Future of Synthetic Life and DeFi

As synthetic biology and DeFi mature, we can expect:

- Living NFTs

NFTs representing synthetic organisms that evolve over time, creating dynamic value. - Decentralized Research Hubs

Entire labs funded and governed by DAOs, where global citizens vote on research priorities. - Programmable Organisms as Assets

Organisms designed for specific tasks, such as producing medicine or cleaning oceans, could be monetized through DeFi platforms.

Breaking Down the Barriers

The fusion of synthetic life and DeFi isn’t just a possibility—it’s an emerging reality. This convergence promises to democratize access to cutting-edge research, create new economic models, and redefine what it means to own “life.”

Whether you’re a child imagining the future, a researcher seeking funding, or an investor exploring the next big thing, the synthetic life-DeFi ecosystem holds something for everyone.

The real question is: Are we ready for a world where life itself becomes a financial asset?

Must Read : Prediction Markets