Kraken Receives Mt. Gox Funds

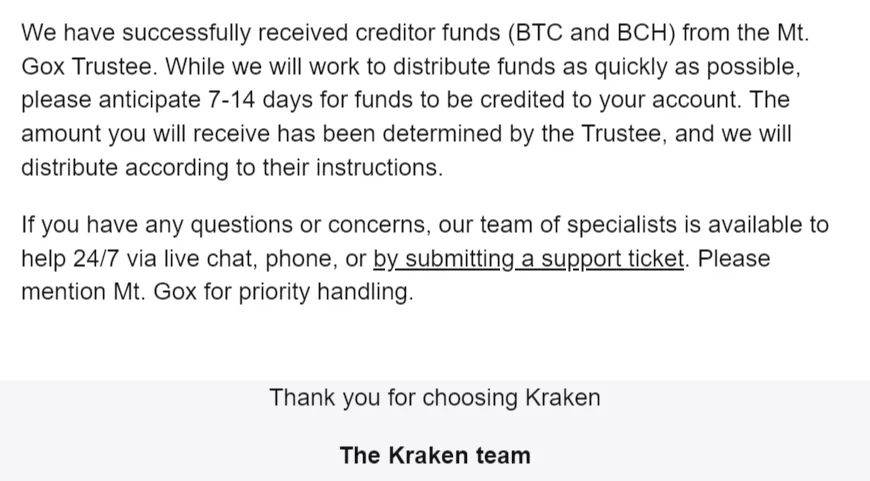

Kraken has confirmed the successful receipt of Bitcoin (BTC) and Bitcoin Cash (BCH) from the Mt. Gox trustee, marking a significant milestone in the long-running saga of the defunct exchange’s rehabilitation process. In an email to creditors, Kraken stated, “We have successfully received creditor funds (BTC and BCH) from the Mt. Gox Trustee. While we will work to distribute funds as quickly as possible, please anticipate 7-14 days for funds to be credited to your account.”

This announcement follows the recent movement of approximately 47,000 Bitcoin from Mt. Gox addresses to two new addresses. One of these addresses, containing 48,000 Bitcoin, is believed to belong to Kraken due to its SegWit (Segregated Witness) format. The ownership of the second address remains unclear.

Why is Mt. Gox Paying Back Now?

The repayment process is the culmination of years of legal proceedings and negotiations aimed at compensating creditors. The Tokyo District Court-approved rehabilitation plan outlines the distribution of recovered assets. This legal obligation, managed by rehabilitation trustee Nobuaki Kobayashi, aims to bring closure to the long-running ordeal and restore some measure of trust in the cryptocurrency ecosystem.

The rehabilitation process has been complex and lengthy due to the sheer scale of the loss and the number of creditors involved. The Mt. Gox collapse in 2014 was a significant event in the crypto world, causing a dramatic drop in Bitcoin prices and highlighting the vulnerabilities of cryptocurrency exchanges. The trustee’s efforts have focused on recovering as much of the lost assets as possible and distributing them fairly among the creditors.

Recent Developments

In May 2024, Mt. Gox transferred 141,686 BTC, worth $9.62 billion, to a new wallet address. This move was part of the repayment preparation process and marked the first on-chain activity from the exchange in over five years. This transfer confirmed the trustee’s commitment to repaying creditors and represented a crucial step towards the rehabilitation plan’s implementation.

As Kraken begins the process of crediting user accounts, it brings a measure of closure to one of the industry’s most notorious incidents. This development not only compensates those affected but also reinforces the importance of security and trust within the cryptocurrency industry.

Impact on Bitcoin Price

The commencement of repayments has potential implications for the Bitcoin market. The redistribution of such a significant amount of BTC might introduce increased volatility. Historically, large movements of Bitcoin, especially those tied to high-profile incidents like Mt. Gox, have influenced market dynamics. However, the gradual and structured distribution process managed by Kraken aims to mitigate sudden impacts on Bitcoin’s price.

Conclusion

The Mt. Gox repayment process marks a significant milestone in the cryptocurrency world. As Kraken begins distributing the funds, creditors can finally see the resolution of an ordeal that began a decade ago. This development not only compensates those affected but also reinforces the importance of security and trust within the cryptocurrency industry. The Mt. Gox saga serves as a stark reminder of the challenges the crypto market has faced and the progress it continues to make towards a more secure and reliable future. The impact on Bitcoin prices remains to be fully seen, but the structured repayment process is a positive step towards stability and recovery.