Pump.fun, a well-known decentralized platform, rose to prominence in the cryptocurrency world by enabling users to create tokens backed by virtual liquidity pools. It catered to a niche but rapidly growing market within the blockchain ecosystem, particularly on the Solana blockchain.

However, its journey hit a roadblock recently when regulators in the United Kingdom banned the platform. This move has sparked debates about regulatory compliance, the challenges faced by decentralized platforms, and the future of token creation platforms in a tightening regulatory landscape.

In this article, we will delve into the reasons for Pump.fun’s UK ban, its impact on users, and the viable alternatives available on Solana, Binance Smart Chain, TRON, and other blockchains for those looking to create virtual liquidity tokens.

Understanding Pump.fun

What is Pump.fun?

Pump.fun is a decentralized platform that enables users to create and trade custom tokens backed by virtual liquidity pools. The platform’s innovative approach attracted a diverse user base, from hobbyists to crypto developers looking to experiment with tokenomics

One of Pump.fun’s standout features was its simplicity. Users could create tokens with customizable parameters and deploy them with synthetic liquidity, making it accessible even for those without technical expertise. Additionally, its integration with Solana ensured fast transaction speeds and low fees, further boosting its appeal.

Reasons for its Popularity:

Pump.fun’s success can be attributed to its ability to capitalize on emerging blockchain trends, such as community-driven tokenomics and synthetic liquidity. The platform provided tools for creators to test and launch tokens quickly, fostering a vibrant ecosystem of experimentation and innovation.

Why Pump.fun was banned in the UK?

The Financial Conduct Authority (FCA) in the UK has been increasing its scrutiny of cryptocurrency platforms, focusing on compliance, transparency, and user protection. Pump.fun failed to meet the stringent requirements set forth by the FCA, leading to its ban in the region.

Regulatory Concerns:

According to reports, Pump.fun lacked the necessary mechanisms to ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) standards. This raised concerns about the platform being potentially used for fraudulent activities or market manipulation.

User Complaints and Risks:

Several users reported issues related to token liquidity, which further attracted regulatory attention. The FCA’s decision to ban Pump.fun reflects a broader trend of tightening crypto regulations to mitigate risks associated with unregulated platforms

Beyond the UK, this ban sends a strong signal to other jurisdictions to examine similar platforms, potentially influencing global regulatory policies.

Consequences of the Pump.fun Ban

Immediate Impacts on UK-Based Users

The ban had an immediate effect on UK-based users, many of whom found themselves unable to access their accounts or continue their token creation activities. In some cases, users reported frozen assets or abrupt disruptions to community-driven projects reliant on Pump.fun’s services. This left many scrambling for alternatives, often without clear guidance on how to proceed

Loss of Trust in Decentralized Platforms

Pump.fun’s ban is not just a setback for its users but also a blow to the reputation of decentralized platforms. When such services fail to comply with regulations or protect user interests, they risk eroding the trust of the broader crypto community. This could lead to hesitation among users when adopting new or lesser-known platforms, slowing the pace of innovation

Ripple Effects Across Jurisdictions

The ban in the UK has set a precedent that could influence regulatory actions in other countries. Governments worldwide are observing how platforms like Pump.fun operate and whether they comply with local laws. If similar concerns arise, more regions may follow suit, potentially leading to further restrictions and challenges for the decentralized finance (DeFi) sector.

Exploring Alternatives to Pump.fun

Despite the ban, several platforms offer similar capabilities, particularly for users interested in creating tokens with virtual liquidity pools. Here are some noteworthy alternatives on Solana, Binance Smart Chain, TRON, and other blockchain networks:

On Binance Smart Chain (BSC):

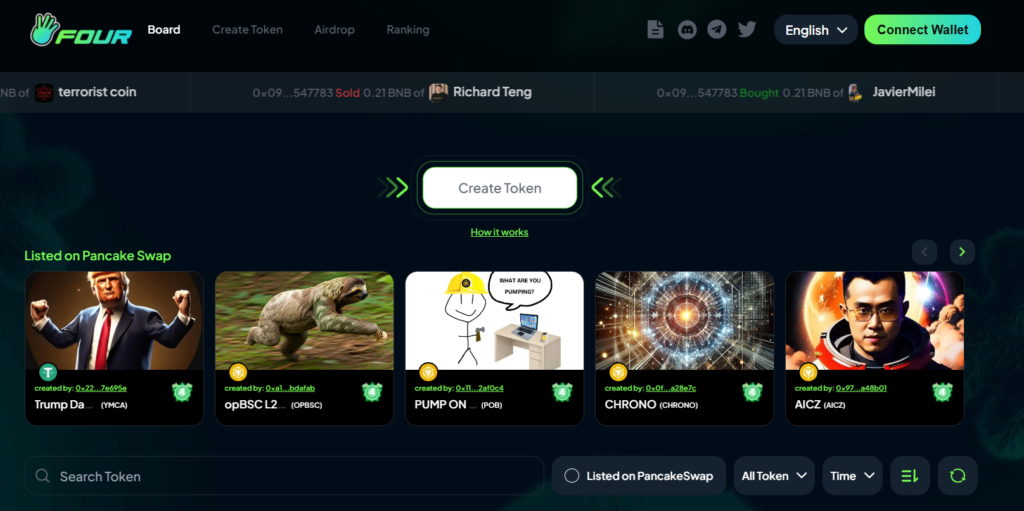

- Four.meme

This platform allows users to create custom tokens backed by virtual liquidity pools. It offers a user-friendly interface and extensive community support, making it a solid alternative for those previously reliant on Pump.fun. Four.meme also integrates community engagement tools, enhancing token promotion and adoption.

On TRON:

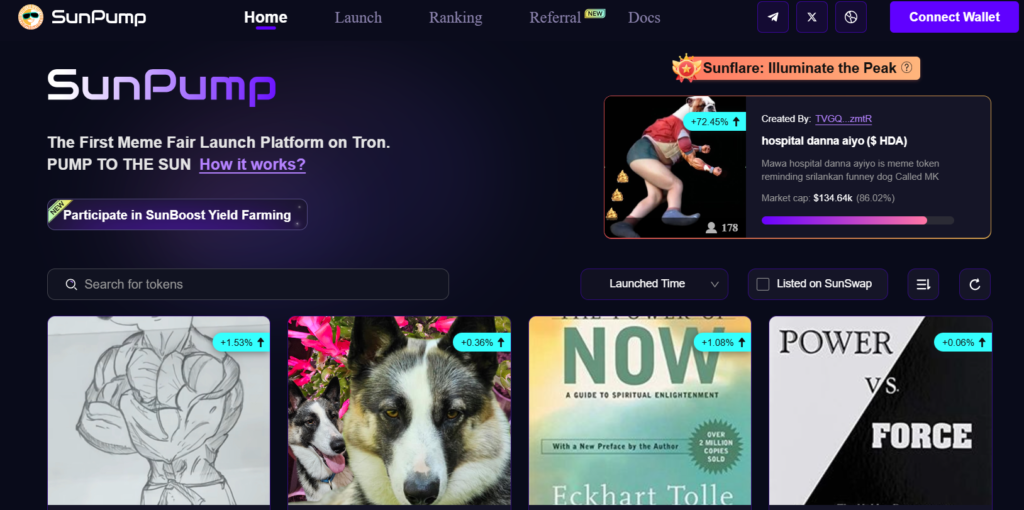

- Sunpump.meme

A TRON-based alternative, Sunpump.meme specializes in virtual liquidity and token creation. It is designed to be accessible to both developers and non-technical users, providing flexibility in token parameters and liquidity management.

On Solana & Base:

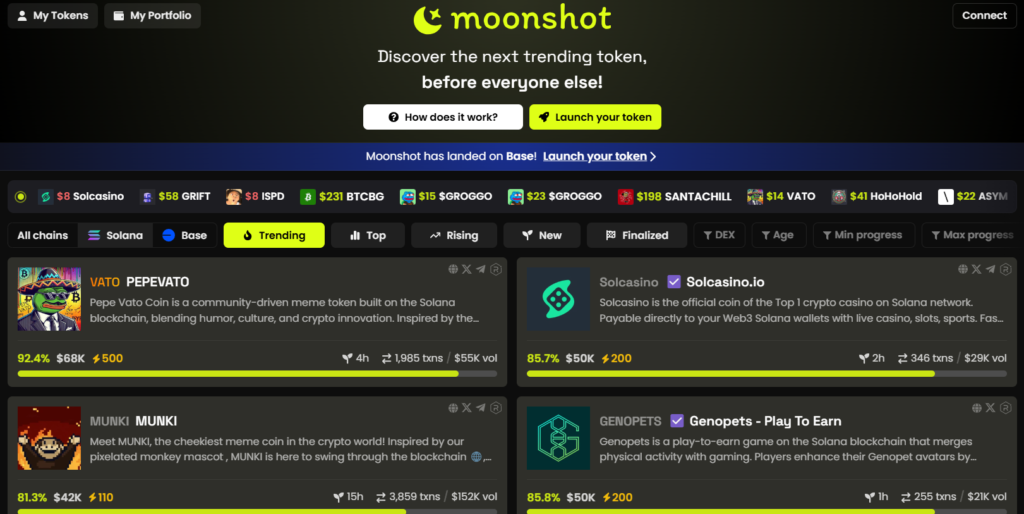

- Moonshot

Moonshot is a platform developed by Desxcreener for token creation on the Solana and Base blockchains, offering virtual liquidity. It operates similarly to pump.fun, allowing users to easily launch tokens with integrated liquidity solutions, helping projects gain traction and visibility within the crypto space.

What This Means for Crypto Regulation

Tightening Regulations Globally

The Pump.fun ban is part of a broader trend of governments worldwide tightening cryptocurrency regulations. Authorities are demanding greater transparency, stricter anti-money laundering (AML) measures, and better protection against fraud. Platforms that fail to comply face bans or operational restrictions, as seen in the UK.

For users, this means that navigating the crypto landscape will require greater vigilance. Relying on compliant platforms ensures not only the safety of funds but also the longevity of the services they use.

Lessons for Crypto Entrepreneurs

Pump.fun’s case serves as a cautionary tale for crypto entrepreneurs. To thrive in an increasingly regulated environment, platforms must prioritize:

- Transparency: Implementing clear and accessible policies for users and regulators.

- Compliance: Integrating AML, know-your-customer (KYC), and other legal frameworks.

- User Protection: Ensuring mechanisms for dispute resolution, fund security, and fraud prevention.

Balancing Innovation and Regulation

While regulations aim to protect users, overly strict policies could stifle innovation. Governments and platforms must work together to strike a balance that fosters creativity while safeguarding users. Encouraging industry self-regulation and adopting decentralized governance models could provide solutions that satisfy both regulators and innovators.

User Responsibility in Choosing Platforms

As the cryptocurrency space evolves, users must take responsibility for vetting the platforms they choose. While innovative platforms like Pump.fun and its alternatives provide exciting opportunities, they also come with risks. Here’s how users can make informed decisions:

How to Evaluate Crypto Platforms

- Check for Transparency: Ensure the platform provides clear information about its team, policies, and regulatory compliance.

- Look for Audits: Platforms with third-party audits are more likely to be secure and reliable.

- Analyze User Feedback: Community reviews can provide insights into the platform’s strengths and weaknesses.

Red Flags to Watch For

- Lack of Documentation: Platforms that fail to provide detailed guidelines for users often lack transparency.

- High Fees or Hidden Costs: Carefully evaluate the fee structure to avoid unexpected charges.

- Over-Promising Features: Be wary of platforms that make unrealistic claims about returns or functionality.

Community-Driven Checks and Balances

The decentralized nature of crypto platforms means that users collectively have the power to hold platforms accountable. Participating in community discussions and governance can help identify potential issues early and push for necessary improvements.

Conclusion

The ban on Pump.fun in the UK highlights the challenges faced by decentralized platforms in meeting regulatory standards. While it has disrupted the activities of many users, it also underscores the need for transparency, compliance, and user protection in the crypto space.

Fortunately, several alternatives exist for creating virtual liquidity tokens. Platforms like Four.meme, Sunpump.meme and Moonshot offer diverse options across multiple blockchains. By evaluating these alternatives carefully, users can continue exploring innovative tokenomics without compromising on safety and compliance.

As the crypto industry matures, both regulators and innovators must collaborate to create an environment that fosters growth while safeguarding users. By staying informed and vigilant, users can navigate this dynamic landscape and contribute to its evolution.

Must Read – Print on Solana: Transforming DeFi with Transfer Hooks and Revenue Sharing